- By Function

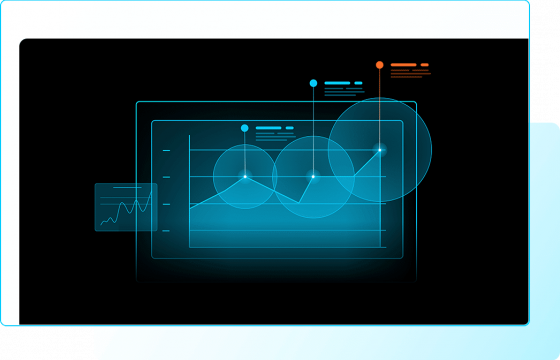

Optimise Your Finance Performance

At Ipsos Jarmany, we’ll help you to transform your financial reporting and processes, in turn providing you with more accurate reporting, reduced reporting time and minimised human error.

We provide a range of data services to help our clients uncover the true story their data is telling them and facilitate data-driven decision making.

Our expertise spans 5 key technical areas, from data visualisation to data science. Explore our solutions based on your technical requirements or by your business function.

Explore our Solutions

We provide a range of data services to help our clients uncover the true story their data is telling them and facilitate data-driven decision making.

Our expertise spans 5 key technical areas, from data visualisation to data science. Explore our solutions based on your technical requirements or by your business function.

We are experts in helping

organisations use their data to help

optimise their finance processes

including automated financial reporting, and revenue forecasting.

We’re on a mission to build a world-class organisation that helps businesses transform the way they manage and utilise data. Find out more about us, our people and how we’re planning on achieving our mission.

About Us

We’re on a mission to build a world-class organisation that helps businesses transform the way they manage and utilise data. Find out more about us, our people and how we’re planning on achieving our mission.

Explore our resources hub for the latest insights, guides, demos and case studies.

Resources

Explore our resources hub for the latest insights, guides, demos and case studies.

Explore our resources hub for the latest insights, guides, demos and case studies.

Join the Jarmany Team

Looking to launch a career in data and analytics at a company that values learning, development and social connections?

Check out our current vacancies today.

We provide a range of data services to help our clients uncover the true story their data is telling them and facilitate data-driven decision making.

Our expertise spans 5 key technical areas, from data visualisation to data science. Explore our solutions based on your technical requirements or by your business function.

Explore our Solutions

We provide a range of data services to help our clients uncover the true story their data is telling them and facilitate data-driven decision making.

Our expertise spans 5 key technical areas, from data visualisation to data science. Explore our solutions based on your technical requirements or by your business function.

We are experts in helping

organisations use their data to help

optimise their finance processes

including automated financial reporting, and revenue forecasting.

We’re on a mission to build a world-class organisation that helps businesses transform the way they manage and utilise data. Find out more about us, our people and how we’re planning on achieving our mission.

About Us

We’re on a mission to build a world-class organisation that helps businesses transform the way they manage and utilise data. Find out more about us, our people and how we’re planning on achieving our mission.

Explore our resources hub for the latest insights, guides, demos and case studies.

Resources

Explore our resources hub for the latest insights, guides, demos and case studies.

Explore our resources hub for the latest insights, guides, demos and case studies.

Join the Jarmany Team

Looking to launch a career in data and analytics at a company that values learning, development and social connections?

Check out our current vacancies today.

At Ipsos Jarmany, we’ll help you to transform your financial reporting and processes, in turn providing you with more accurate reporting, reduced reporting time and minimised human error.

Data, analysis and reporting processes within finance teams can often involve repetitive and manual processes that run the risk of human-error. Artificial intelligence (AI) can help you circumnavigate these challenges by automating processes and uncovering insights which may otherwise be overlooked.

At Ipsos Jarmany, we can build and implement a variety of AI solutions to help you manage your financial reporting, including:

We can support you with:

Management finance involves a lot of time-consuming, manual and repetitive tasks which is prone to human-error and oversight.

Automation can help to mitigate these risks by streamlining these manual processes and, in turn, allows businesses to reduce lagtime between processes financial data and delivering these reports to stakeholders, as well as re-allocating resources so that employees can focus on higher-priority tasks.

At Ipsos Jarmany, we have experience automating these manual financial reporting processes through platforms, like Power BI Logic, to remove the need for manual and mundane tasks.

We can support you with:

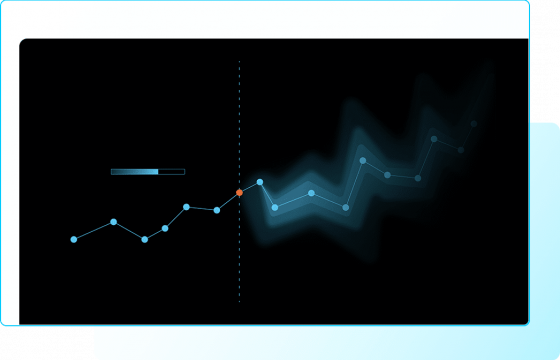

We understand the significance of revenue forecasts in driving and predicting business outcomes. As such, we’ve created a solution that automatically generates revenue forecasts based on previous behaviour and other macroeconomic factors that may impact performance.

By using the latest inputs to the funnel from sales teams, and leveraging pipeline data, we can calculate weighted revenue forecasts from unconfirmed orders, so you can accurately predict future revenue streams and make business decisions accordingly.

We can support you with:

As with many global companies, products are often sold not only through D2C, but through third-party retailers. And, behind each third-party partnership is often an incentive agreement defining the pay-out that these partners can expect based on the amount of sales they generate during promotional periods.

At Ipsos Jarmany, we have created an end-to-end service to help with incentive management so you can easily forecast, track and validate these claims before generating any pay-outs.

We can support you with:

What We Do

Resources

Careers

Important Information

Speak To A Member Of The Team

By entering your email address you’re agreeing to the terms outlined in our Privacy Policy.